Overview

UnitedHealthcare may cover Ozempic for weight loss, but eligibility is contingent upon specific criteria, including:

- Medical necessity

- BMI thresholds

- Prior authorization requirements

Coverage can vary significantly, making it essential for individuals to review their insurance documents thoroughly. Furthermore, consulting healthcare providers and gathering the necessary documentation to support the request for this medication is crucial. This proactive approach can help ensure that all criteria are met for potential coverage.

Introduction

Navigating the complexities of health insurance can often feel daunting, particularly when it comes to understanding coverage for specific medications like Ozempic, which has garnered attention for its potential in weight loss. With nearly half of employer plans now including GLP-1 medications, it is crucial for those seeking effective solutions to know whether UnitedHealthcare supports Ozempic for weight management.

However, the path to securing coverage presents numerous questions regarding:

- Eligibility

- Medical necessity

- Prior authorization requirements

This leaves many individuals wondering: what steps must be taken to ensure that this valuable treatment is accessible?

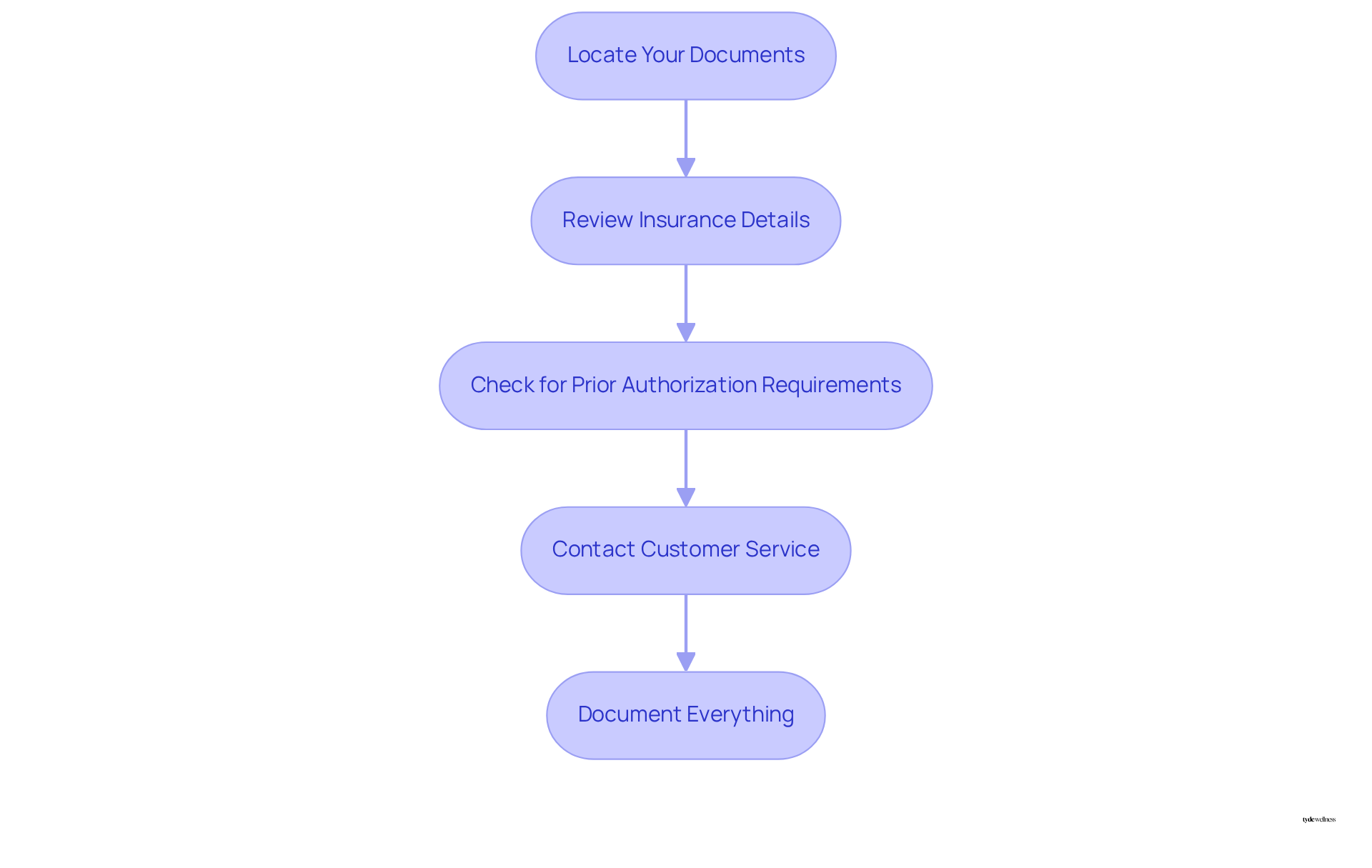

Understand Your UnitedHealthcare Plan Details

- Locate Your Documents: Begin by accessing your UnitedHealthcare documents, which include the Summary of Benefits and Coverage (SBC) and the Prescription Drug List (PDL). These documents are essential as they outline the medications covered under your plan and any specific requirements that may apply.

- Review Insurance Details: Carefully examine the sections detailing prescription drug benefits. It is important to pay special attention to notes regarding weight loss medications, especially to find out if UnitedHealthcare does cover Ozempic for weight loss, as support for these can differ significantly from standard medications.

- Check for Prior Authorization Requirements: Many UnitedHealthcare policies require prior approval for specific medications, including a similar drug. This process may require your healthcare provider to submit additional documentation to justify the .

- Contact Customer Service: If you have any inquiries regarding your policy, reach out to the customer service number listed on your insurance card. Representatives can offer detailed information about your program’s benefits related to the medication and assist you with any required actions.

- Document Everything: Maintain a detailed record of any interactions with customer service, including names, dates, and the specifics of your discussions. This documentation can be invaluable if you face any problems with your insurance later on.

As of 2024, around 44% of employer plans from firms with 500 or more employees include GLP-1 medications such as Ozempic for reducing pounds, which raises the question: does UnitedHealthcare cover Ozempic for weight loss? Consulting with insurance specialists can also offer insight on navigating policy information effectively.

At Tyde Wellness, we empower women through community engagement, offering personalized weight loss solutions that incorporate GLP-1 therapy and holistic support. As a Tyde Circle member, you can actively participate in local discussions, share your experiences, and help others navigate their wellness journeys.

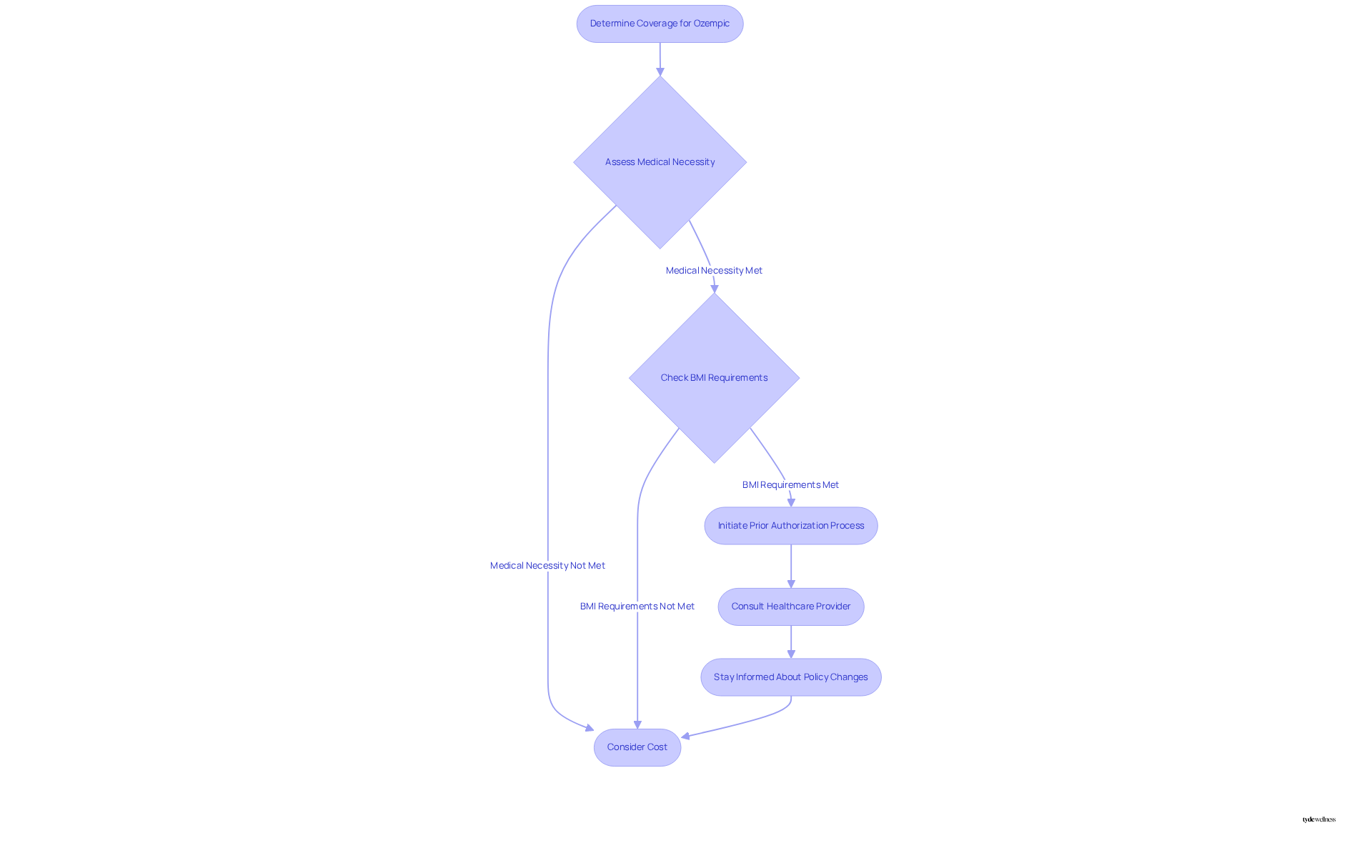

Identify Coverage Criteria for Ozempic

Understanding the criteria is essential to determine if .

Medical Necessity: Ozempic is primarily prescribed for managing Type 2 diabetes. To qualify for benefits, a diagnosis of diabetes or another qualifying condition is typically required. Review your medical history to determine if you meet these criteria.

Body Mass Index (BMI) Requirements: UnitedHealthcare typically requires specific BMI thresholds to assess whether it covers Ozempic for weight loss. A BMI of 30 or higher is usually necessary, or a BMI of 27 with weight-related comorbidities such as hypertension or dyslipidemia. Approximately 25% of health programs cover GLP-1 drugs for weight loss, which may influence your chances of obtaining coverage.

Prior Authorization Process: Many programs necessitate prior authorization for the medication. Ensure your healthcare provider submits the necessary documentation, which may include medical records and a treatment strategy justifying the use of this medication for your condition.

Consult Your Healthcare Provider: Discuss your weight loss objectives and the potential use of this medication with your healthcare provider. They can help assess your eligibility and assist with the prior authorization process if needed. It’s also important to recognize that some insurance policies may not cover this medication, so understanding your specific arrangement is essential.

Stay Informed About Policy Changes: Insurance policies can change annually. Consistently verify updates to your plan or reach out to customer service to remain informed about any modifications that may influence your benefits.

Cost Considerations: The typical expense of this medication without insurance can surpass $1,300 monthly, making insurance support essential for numerous patients. Additionally, inquire about patient assistance programs that may help reduce costs if you find yourself struggling with the price.

Comprehending these criteria is vital for obtaining coverage and understanding whether UnitedHealthcare covers Ozempic for weight loss to ensure that your weight loss journey is supported effectively.

Gather Necessary Documentation

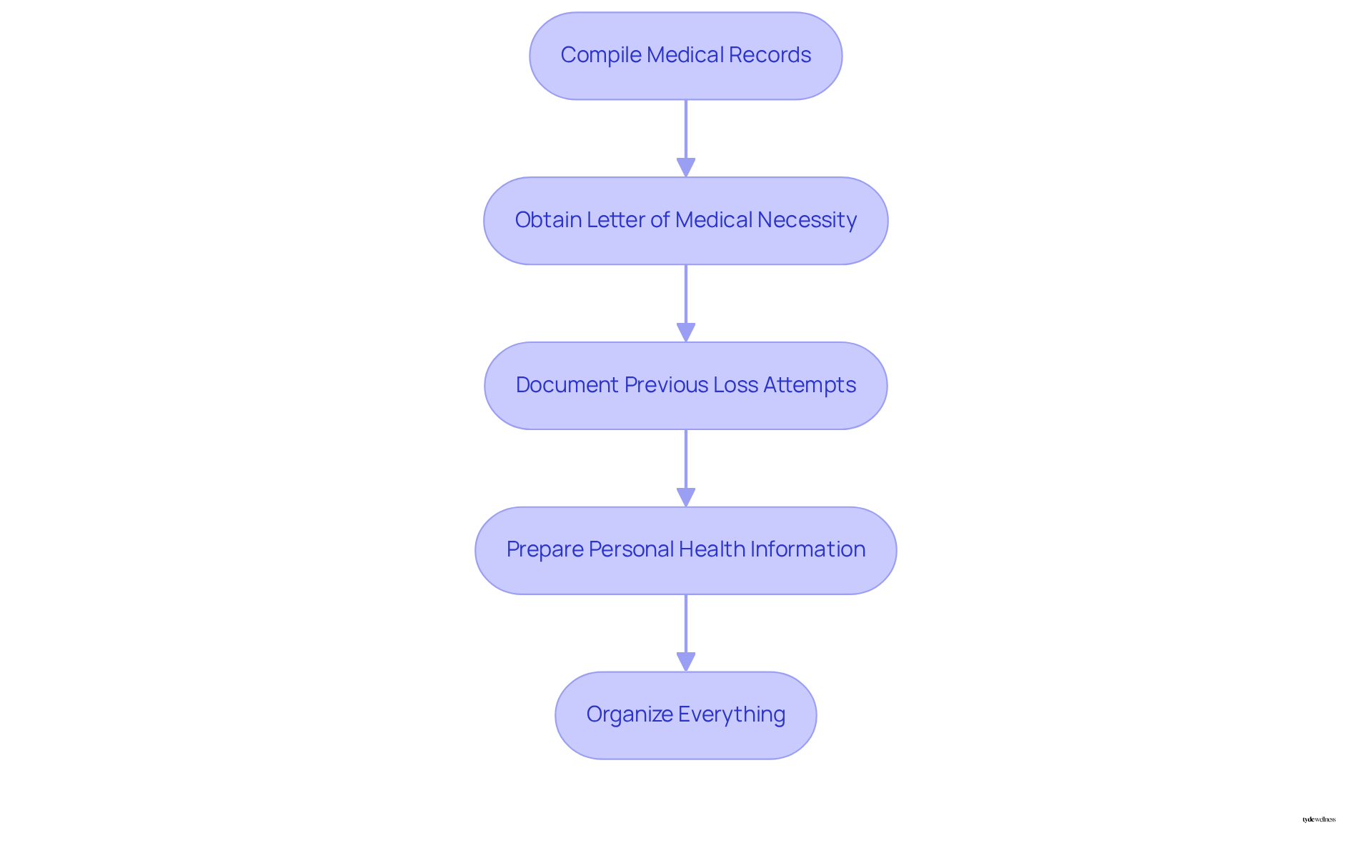

- Compile Medical Records: Begin by gathering essential medical records that substantiate your need for Ozempic. This should include prior diagnoses, treatment history, and specifics of any medications you have attempted for managing your body mass. As a member of the Tyde Circle, you can share your journey and insights with others, fostering a supportive community that empowers women in their weight loss efforts.

- Obtain a Letter of Medical Necessity: Request a letter from your healthcare provider that articulates the necessity of the medication for your treatment. This letter should encompass your medical history, current health status, and the expected benefits of using this medication, as many healthcare professionals emphasize its significance in securing insurance coverage. As Femi Aremi, PharmD, advises, “Before beginning the medication, inform your healthcare provider about all your treatments, including prescriptions, OTC drugs, natural products, and vitamins.”

- Document Previous Loss Attempts: Compile records of any past weight loss efforts, including diets, medications, and other interventions. This documentation can effectively demonstrate the necessity for a more powerful solution like Ozempic, particularly since studies indicate that many patients achieve significant weight loss with this medication. Participants at Tyde Wellness have reported an average body mass loss of 15% after 68 weeks, underscoring the effectiveness of the personalized support and GLP-1 therapy offered.

- Prepare Personal Health Information: Be ready to provide personal health details, such as your BMI, any comorbidities, and lifestyle factors that may influence your weight management journey. It’s important to note that some insurance plans may cover anti-obesity medications, which raises the question, does unitedhealthcare cover ozempic for weight loss for individuals with a BMI over 30 or at least 27 with additional comorbid conditions? Tyde Wellness offers to assist you in navigating these requirements effectively.

- Organize Everything: Create a folder—either physical or digital—to keep all your documentation organized. This will streamline the process for your healthcare provider when submitting the necessary information for prior authorization, ensuring that all required paperwork is readily accessible. Remember, as a Tyde Circle member, you have access to resources and support that can simplify this process.

Conclusion

Understanding whether UnitedHealthcare covers Ozempic for weight loss is essential for those seeking effective solutions to manage their weight. This article outlines the necessary steps to navigate your insurance plan, emphasizing the importance of reviewing policy details, understanding coverage criteria, and gathering the appropriate documentation to support your request.

Key insights include:

- Determining your eligibility based on medical necessity

- BMI requirements

- The prior authorization process

By proactively engaging with your healthcare provider and maintaining organized records, you can enhance your chances of obtaining the coverage you need. Furthermore, staying informed about any changes to your policy ensures you remain aware of your benefits.

Ultimately, seeking coverage for Ozempic under UnitedHealthcare can significantly impact your weight loss journey. By following the outlined steps and utilizing available resources, individuals can empower themselves to make informed decisions. Taking charge of your health and understanding your insurance options is crucial in achieving successful weight management.

Frequently Asked Questions

What documents should I locate to understand my UnitedHealthcare plan details?

You should access your UnitedHealthcare documents, including the Summary of Benefits and Coverage (SBC) and the Prescription Drug List (PDL), as these outline the medications covered under your plan and any specific requirements.

What should I review in my insurance details regarding prescription drugs?

You should carefully examine the sections detailing prescription drug benefits, paying special attention to notes about weight loss medications and whether UnitedHealthcare covers Ozempic for weight loss.

Are there any prior authorization requirements for medications under UnitedHealthcare?

Yes, many UnitedHealthcare policies require prior approval for specific medications, which may involve your healthcare provider submitting additional documentation to justify the medical necessity of the medication.

How can I get more information about my UnitedHealthcare policy?

You can contact customer service using the number listed on your insurance card. Representatives can provide detailed information about your program’s benefits related to medications and assist with any required actions.

Why is it important to document interactions with customer service?

Maintaining a detailed record of interactions with customer service, including names, dates, and specifics of discussions, can be invaluable if you encounter any issues with your insurance later on.

What percentage of employer plans include GLP-1 medications like Ozempic as of 2024?

As of 2024, around 44% of employer plans from firms with 500 or more employees include GLP-1 medications such as Ozempic for weight loss.

How can I get help navigating my UnitedHealthcare policy information?

Consulting with insurance specialists can provide insight into effectively navigating your policy information.

List of Sources

- Understand Your UnitedHealthcare Plan Details

- UnitedHealthcare 2025 Medicare Advantage Plans Deliver Choice, Stability (https://unitedhealthgroup.com/newsroom/2024/2024-10-01-uhc-2025-medicare-advantage-new-benefits.html)

- Does Medicare Cover Popular Drugs for Weight Loss? (https://aarp.org/medicare/faq/does-medicare-cover-ozempic-weight-loss-drugs)

- Weight loss drugs like Ozempic could soon be in reach (https://northcarolinahealthnews.org/2025/05/30/weight-loss-drugs-like-ozempic-could-soon-be-in-reach)

- Does United Healthcare cover Ozempic? (https://singlecare.com/blog/does-united-healthcare-cover-ozempic)

- Identify Coverage Criteria for Ozempic

- UnitedHealth wants to make weight loss drugs cheaper – Becker’s Payer Issues | Payer News (https://beckerspayer.com/payer/unitedhealth-wants-to-make-ozempic-wegovy-cheaper)

- Does United Healthcare cover Ozempic? (https://singlecare.com/blog/does-united-healthcare-cover-ozempic)

- Insurance companies scrambling to support need for GLP-1 drugs (https://insurancenewsnet.com/innarticle/insurance-companies-scrambling-to-support-need-for-glp-1-drugs)

- Get The Most Prescribed Generic Medications FREE! (https://freerx.com/Blog/Details?s=Ozempic-Insurance-Coverage)

- Insurance Coverage For Ozempic, Zepbound Went Down In 2025 (https://forbes.com/sites/brucelee/2025/03/21/insurance-coverage-for-ozempic-zepbound-went-down-in-2025)

- Gather Necessary Documentation

- Young people are increasingly using Wegovy and Ozempic (https://michiganmedicine.org/health-lab/young-people-are-increasingly-using-wegovy-and-ozempic)

- How to Quality for an Ozempic Prescription: Steps (https://verywellhealth.com/how-to-get-ozempic-8675757)

- Getting Ozempic Covered by Insurance and Prior Authorization Process (https://sprypt.com/blog/ozempic-insurance-coverage-authorization)

- How to get insurance to cover Ozempic for weight loss (https://singlecare.com/blog/how-to-get-insurance-to-cover-ozempic-for-weight-loss)