Introduction

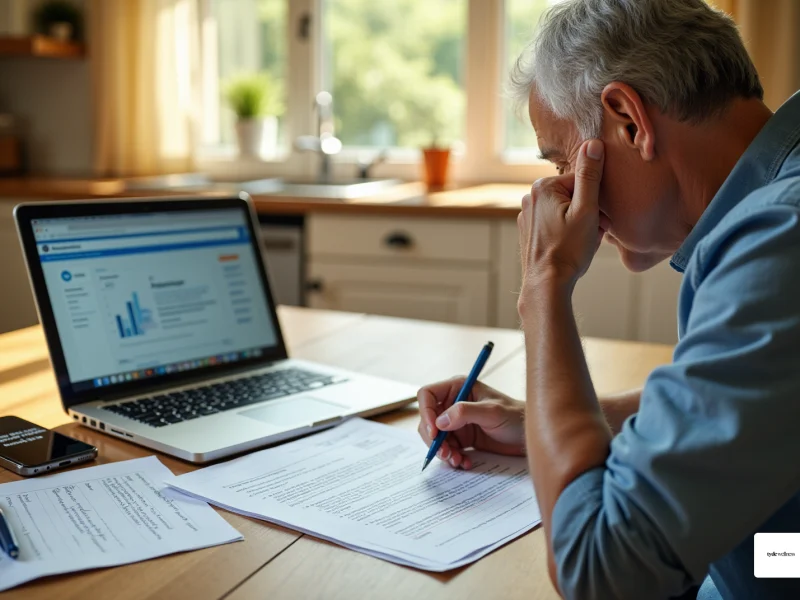

Navigating the complexities of insurance coverage for GLP-1 medications can be daunting, especially as these treatments become increasingly popular for weight management. Understanding how to secure coverage not only reduces financial stress but also paves the way for effective health solutions. However, the process often presents challenges.

What should you do if a claim is denied, or if specific documentation is needed? This guide provides a clear roadmap through the insurance maze, empowering individuals to advocate for their health and access the medications they require.

Check Your Insurance Coverage for GLP-1 Medications

- To learn [[how to get GLP-1 covered by insurance](https://glpwinner.com/insights/how-states-are-handling-glp-1-coverage-changes-in-2026-and-what-it-means-for-you)](https://tydewellness.com/learn/is-semaglutide-hsa-eligible-verify-your-coverage-today), start by reviewing your insurance provider’s formulary, which details the drugs covered under your plan. This information is usually available on their website or by reaching out to customer service directly.

- Identify GLP-1 Treatments: Look for specific GLP-1 treatments, including Ozempic, Wegovy, or Zepbound. Be mindful of any restrictions or requirements that may apply when considering how to get GLP-1 covered by insurance.

- Understand Coverage Levels: Assess whether these drugs are included in your plan and at what coverage level, distinguishing between generic and brand-name options. This understanding will help you anticipate any potential out-of-pocket expenses.

- Verify Prior Approval Criteria: Some coverage plans may necessitate for GLP-1 drugs. This means your healthcare provider will need to submit additional documentation to justify how to get GLP-1 covered by insurance for the treatment.

- Contact Customer Service: If you have questions or need further clarification, don’t hesitate to reach out to your provider’s customer service. They can provide valuable insights into your coverage options and any recent updates regarding weight loss medications.

Request Coverage Criteria from Your Insurance Provider

- Contact your insurance provider to inquire about how to get GLP 1 covered by insurance by reaching out to your insurance company, either by phone or through their online portal, to request the coverage criteria for weight loss treatments. Since coverage can vary significantly, it’s crucial to .

- Ask Specific Questions: Be sure to inquire about the medical necessity guidelines and any documentation needed for approval. This may include diagnosis codes or treatment history, which are essential for your request.

- Document the Conversation: During your conversation, take detailed notes, including the names of the representatives you speak with and any reference numbers they provide. This documentation will be valuable later in the process.

- Request Written Confirmation: If possible, ask for written confirmation of the coverage criteria. This document can serve as a helpful reference when you submit your treatment request.

- Review the Criteria: After receiving the information, review it thoroughly to ensure you understand what is required for your situation. If your plan does not cover these specific treatments, consider that Tyde Wellness offers compounded alternatives to help you access the care and assistance you need.

Collaborate with Your Prescriber to Secure Coverage

- Schedule an appointment to meet with your healthcare professional to discuss [how to get GLP-1 covered by insurance](https://tydewellness.com/learn/how-much-does-tirzepatide-cost-key-factors-and-savings-strategies) and the process for coverage. This initial step is crucial for establishing a clear understanding of your health needs and the potential benefits of the medication.

- To share insurance information, provide your prescriber with details on how to get GLP-1 covered by insurance, including the . This information is vital as it helps your healthcare provider understand the specific requirements for approval, ensuring that your case is presented effectively.

- Discuss how to get GLP-1 covered by insurance by collaborating with your prescriber to articulate the medical necessity for the treatment. This discussion should include your health history, weight management goals, and any related health conditions. Engaging with your Tyde Circle community can offer additional support and encouragement during this process.

- Prepare Documentation: Ensure your prescriber has all necessary documentation ready, including any required forms or letters that justify the need for the medication. Proper documentation can enhance the likelihood of approval, which is essential for understanding how to get GLP-1 covered by insurance, as it provides insurers with the evidence they need to support your case. Utilize resources and conversation starters provided by Tyde Wellness to feel confident in your discussions.

- Follow Up: After your appointment, check back with your prescriber to confirm that they have submitted the required documents to your coverage company. Staying proactive in this step can help expedite the approval process and ensure that you receive the support you need. Remember, as part of the Tyde Circle, you are not alone in this journey; support is available to help you navigate the process.

Appeal Denied Coverage Requests and Explore Alternatives

- Review the Denial Letter: Begin by thoroughly examining the denial letter from your coverage company. Understanding how to get GLP-1 covered by insurance is essential, as it will shape your appeal strategy and help you determine what documentation may be required.

- Gather Supporting Documentation: Collect all relevant documentation that can strengthen your case. This includes medical records, correspondence from your healthcare provider detailing the medical necessity of the GLP-1 treatment, and any other evidence that supports your claim regarding how to get GLP-1 covered by insurance. Strong documentation is crucial for a successful appeal.

- Write an Appeal Letter: Compose a formal appeal letter that directly addresses the reasons stated in the denial letter. Ensure you include all pertinent information and attach your supporting documents. A well-organized appeal can significantly improve your chances of overturning the denial.

- Submit the Appeal: Send your appeal letter along with the supporting documents to your coverage company. Retain copies of everything for your records. Follow any specific submission guidelines mentioned in the denial letter to ensure your appeal is processed correctly.

- Explore Alternative Options: If your appeal is ultimately denied, consult with your healthcare provider about alternative treatments or programs that may be covered by your insurance. Often, there are additional treatments or weight management options available that could meet your needs. Additionally, keep in mind that your participation in Tyde Wellness’s personalized weight loss program can vary based on your individual goals. While some may continue with for long-term weight maintenance, others might transition to a maintenance phase after achieving their target weight. Our team is here to assist you in developing sustainable lifestyle changes that can help maintain your results without the need for ongoing medication.

Conclusion

Navigating the complexities of insurance coverage for GLP-1 medications can be challenging. However, understanding the necessary steps is crucial for securing the support needed for effective weight management. By thoroughly checking insurance policies, collaborating with healthcare providers, and appealing denied requests, individuals can significantly enhance their chances of obtaining coverage for these essential treatments.

Key insights include:

- The importance of reviewing insurance formularies

- Understanding coverage levels

- Verifying prior approval criteria

Furthermore, maintaining clear communication with both insurance representatives and healthcare prescribers can facilitate a smoother process. Documenting conversations and following up diligently can make a notable difference in ensuring that all requirements are met.

Ultimately, this guide empowers individuals to take control of their healthcare journey by providing actionable steps to secure GLP-1 medication coverage. By advocating for oneself and exploring all available resources, including potential alternatives if coverage is denied, individuals can work toward achieving their health goals and maintaining a sustainable lifestyle. The path to effective treatment is within reach, and proactive engagement is key to unlocking the necessary support.

Frequently Asked Questions

How can I find out if my insurance covers GLP-1 medications?

You can check your insurance provider’s formulary, which lists the drugs covered under your plan. This information is typically available on their website or by contacting customer service directly.

What specific GLP-1 treatments should I look for?

You should look for specific GLP-1 treatments such as Ozempic, Wegovy, or Zepbound.

Why is it important to understand coverage levels for GLP-1 medications?

Understanding coverage levels helps you determine if these drugs are included in your plan and at what coverage level, allowing you to anticipate any potential out-of-pocket expenses.

What does prior authorization mean for GLP-1 medications?

Prior authorization means that some coverage plans may require your healthcare provider to submit additional documentation to justify the need for GLP-1 medications before they are covered.

What should I do if I have questions about my coverage for GLP-1 medications?

You should contact your provider’s customer service for clarification. They can provide insights into your coverage options and any recent updates regarding weight loss medications.

List of Sources

- Check Your Insurance Coverage for GLP-1 Medications

- Upcoming Insurance Changes for GLP-1 Medications: What You Need to Know (https://mfmhealth.com/post/upcoming-insurance-changes-for-glp-1-medications-what-you-need-to-know)

- Medicare and Medicaid to Start Covering GLP-1 Drugs for Beneficiaries (https://ritterim.com/blog/medicare-and-medicaid-to-start-covering-glp1-drugs-for-beneficiaries)

- GLP-1 Insurance: How to Find Out if Your Medication Is Covered – GoodRx (https://goodrx.com/conditions/weight-loss/glp-1-insurance-coverage?srsltid=AfmBOooWiXs-01gclZ5lPDay46hLf1zbUiKk7qGnoVyLPi6dUjr16qVM)

- GLP-1 Coverage Changes by State in 2026 | GLP Winner | GLP Winner (https://glpwinner.com/insights/how-states-are-handling-glp-1-coverage-changes-in-2026-and-what-it-means-for-you)

- GLP-1 coverage expansion under Medicare: What digital health companies need to know (https://mwe.com/insights/glp-1-coverage-expansion-under-medicare-what-digital-health-companies-need-to-know)

- Request Coverage Criteria from Your Insurance Provider

- Medicare and Medicaid to Start Covering GLP-1 Drugs for Beneficiaries (https://ritterim.com/blog/medicare-and-medicaid-to-start-covering-glp1-drugs-for-beneficiaries)

- GLP-1 Insurance: How to Find Out if Your Medication Is Covered – GoodRx (https://goodrx.com/conditions/weight-loss/glp-1-insurance-coverage?srsltid=AfmBOop_fz4T90cSh0qrmMF1JvgJIER_UTu5w7ABIBY6ymXMBAiWNV1B)

- Trump Administration Announces New Voluntary Payment Model for Weight-Loss Drugs – ACHI (https://achi.net/newsroom/trump-administration-announces-new-voluntary-payment-model-for-weight-loss-drugs)

- GLP-1 medications for weight loss will no longer be covered by Medi-Cal (https://cmadocs.org/newsroom/news/view/ArticleId/51074/GLP-1-medications-for-weight-loss-will-no-longer-be-covered-by-Medi-Cal)

- GLP-1 Weight-loss drug coverage changes coming for Medicaid members (https://priorityhealth.com/provider/manual/news/pharmacy/12-15-2025-medicaid-glp1-coverage-changes-effective-jan-1-2026)

- Collaborate with Your Prescriber to Secure Coverage

- GoodRx Announces Collaboration with Novo Nordisk to Expand Access to Ozempic® and Wegovy® for $499-Per-Month – GoodRx (https://investors.goodrx.com/news-releases/news-release-details/goodrx-announces-collaboration-novo-nordisk-expand-access?mobile=1&mobile=1&mobile=1)

- Novo Nordisk’s $199 Ozempic deal shows what telehealth platforms can do for pharma (https://statnews.com/2025/11/18/telehealth-pharma-glp1-partnerships-increase-drug-access-boost-sales)

- GLP-1 medications for weight loss will no longer be covered by Medi-Cal (https://cmadocs.org/newsroom/news/view/ArticleId/51074/GLP-1-medications-for-weight-loss-will-no-longer-be-covered-by-Medi-Cal)

- GLP-1 RA Access Improved Through Specialty Pharmacy Collaboration (https://hmpgloballearningnetwork.com/site/frmc/conference-coverage/glp-1-ra-access-improved-through-specialty-pharmacy-collaboration)

- Appeal Denied Coverage Requests and Explore Alternatives

- GLP-1 insurance, approved | Easily appeal denied claims (https://getclaimable.com/glp-1-appeals)

- What to Do When Your Insurance Denies Zepbound or Wegovy – A Pound of Cure | A Bariatric Surgery and Non-Surgical Weight Loss practice in Tucson, AZ (https://poundofcureweightloss.com/insurance-denies-zepbound-or-wegovy)

- Appealing Wegovy denial: Prior authorization, letters, and tips (https://medicalnewstoday.com/articles/drugs-how-to-appeal-wegovy-denial)

- Denied by Insurance? A Pharmacist Tells You How to Appeal (https://t1dexchange.org/denied-by-insurance-a-pharmacist-tells-you-how-to-appeal)

- Appealing a Denied Prior Authorization – Obesity Action Coalition (https://obesityaction.org/action-through-advocacy/access-to-care/access-to-care-resources/appealing-a-denial)