Overview

Semaglutide is typically eligible for Health Savings Account (HSA) coverage when prescribed for qualifying medical conditions, such as type 2 diabetes or obesity. Documentation, such as a Letter of Medical Necessity from a healthcare provider, may be required. While semaglutide is FDA-approved and widely utilized, the specifics of HSA coverage can differ. Therefore, it is crucial to verify eligibility with your HSA administrator to maximize your benefits.

💡 At Tyde Wellness, our care team helps patients navigate HSA and FSA coverage every day – making it easier to use your benefits toward real, lasting results.

Introduction

Navigating the complexities of Health Savings Accounts (HSAs) can be challenging, particularly when it comes to understanding which medications qualify for reimbursement. Semaglutide, a medication recognized for its effectiveness in managing type 2 diabetes and facilitating weight loss, offers a unique opportunity for individuals aiming to maximize their HSA benefits.

However, the eligibility criteria can be complex, leading many to question:

- Is Semaglutide truly covered by HSAs?

- How can individuals ensure they are optimizing their health savings?

This guide will help you understand HSA eligibility, clarify what’s required for coverage, and show how Tyde Wellness can guide you through every step – from verification to treatment.

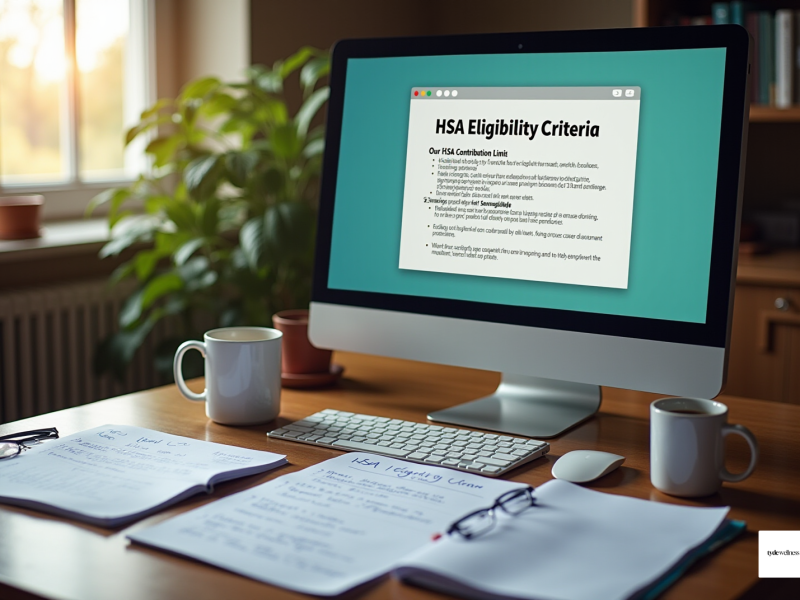

Understand HSA Eligibility Criteria

To qualify for a Health Savings Account (HSA), it is essential to be enrolled in a high-deductible health plan (HDHP). For 2025, the IRS defines an HDHP as having a minimum deductible of $1,650 for individual coverage and $3,300 for family coverage. Furthermore, out-of-pocket expenses must not exceed $8,050 for individuals and $16,600 for families. It is crucial to ensure that your HSA aligns with your health coverage, as not all options meet the necessary criteria. Reviewing your proposal documents or consulting with your HR department can help confirm your eligibility.

For 2025, the HSA contribution limits are established at $4,300 for individual coverage and $8,550 for family coverage. Individuals aged 55 or older are permitted to make an additional catch-up contribution of $1,000 each year. HSAs can only be utilized for qualified medical expenses as outlined by the IRS, which include:

- Prescription medications

- Specific medical treatments

- Preventive care

Importantly, HSA funds can be used tax-free for qualified medical expenses at any time, with unused money rolling over year to year. Understanding these guidelines will enable you to maximize the benefits of your HSA effectively. If you lose HSA eligibility due to life changes, you still own the account and can use the funds for qualified expenses; however, you must stop contributing until you regain eligibility.

💡 Many Tyde Wellness patients use their HSA or FSA funds toward their semaglutide program – it’s a smart, tax-efficient way to invest in your health.

Identify Semaglutide’s HSA Eligibility Requirements

Semaglutide, available under brand names such as Ozempic and Wegovy, is an FDA-approved medication primarily utilized for managing type 2 diabetes and facilitating weight loss. According to IRS guidelines, prescription medications generally qualify for HSA reimbursement if prescribed by a healthcare provider for a specific medical condition. To find out if semaglutide is HSA eligible, a prescription is required and must be documented as necessary for treating a medical condition like obesity or diabetes.

In 2025, many health programs may also require a Letter of Medical Necessity (LMN) from your healthcare provider to confirm that the medication is essential for your health. This requirement underscores the variability in coverage, as some arrangements may not mandate this documentation. Additionally, it is noteworthy that over 137 million U.S. adults are eligible for semaglutide treatment, which encompasses approximately 61.1 million individuals with commercial insurance and 26.8 million Medicare beneficiaries. Given the substantial cost and inconsistent insurance coverage of semaglutide, understanding these requirements can help bridge the gap between healthcare needs and financial accessibility. Always consult your HSA administrator to verify coverage details under your specific arrangement.

💡 Tyde Wellness can provide all necessary documentation, including prescriptions and medical necessity letters, making the HSA reimbursement process seamless. Get a 15-minute free consultation today

Verify Your HSA Coverage for Semaglutide

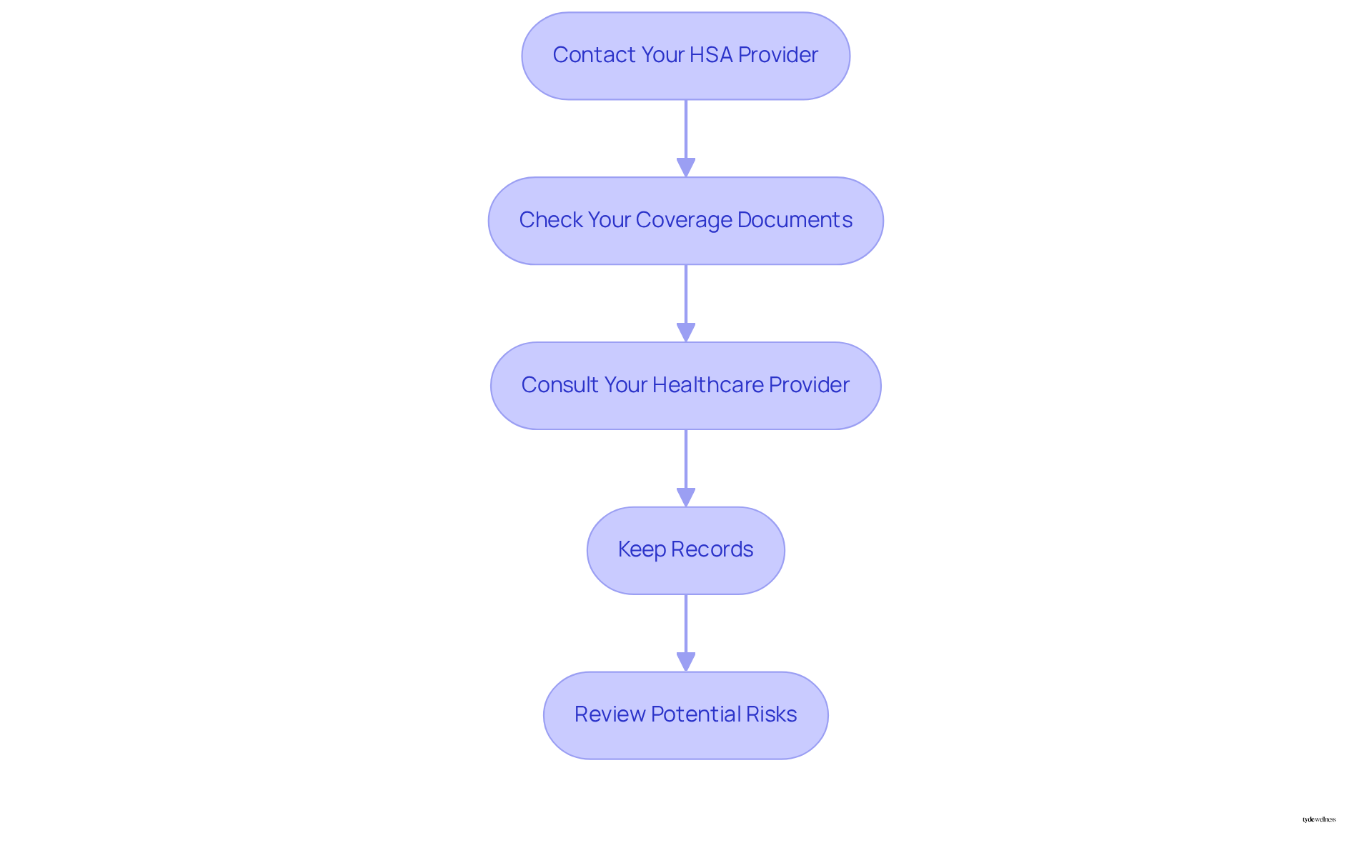

To verify your HSA coverage for Semaglutide, follow these steps:

- Contact Your HSA Provider: Reach out to your HSA administrator or provider to inquire about coverage for Semaglutide. Have your strategy details handy for reference.

- Check Your Coverage Documents: Review your HSA coverage documents for specific mentions of covered medications and reimbursement requirements.

- Consult Your Healthcare Provider: If you have a prescription for Semaglutide, ask your healthcare provider for documentation or a Letter of Medical Necessity, if needed by your HSA arrangement.

- Keep Records: Maintain copies of your prescription, any correspondence with your HSA provider, and receipts for your Semaglutide purchases. This documentation is essential for reimbursement claims or in case of an audit. Detailed records are crucial for FSA/HSA utilization, as unspent funds may be forfeited at the end of the plan year.

By following these steps, you can ensure that you are maximizing your HSA benefits, as semaglutide is HSA eligible, a medication that has demonstrated significant effectiveness in managing body mass, often resulting in reductions exceeding 20-25% within a year for participants in structured programs. Individuals in Tyde Wellness programs indicate an average body reduction of 15% after 68 weeks. However, it is important to be aware of potential risks associated with Semaglutide, including pancreatitis and gallbladder issues. As mentioned by Independence Blue Cross, it is wise to consult your employer for specific coverage information about whether Semaglutide is HSA eligible for Health Savings Accounts (HSA) and/or Flexible Spending Arrangements (FSA).

💬 Need help verifying your coverage? Tyde’s care team can handle this for you in just a few minutes. Book a consultation

Maximize Your HSA Benefits for Weight Loss Medications

To effectively leverage your HSA benefits for weight loss medications such as Semaglutide, consider these essential strategies:

- Consult Your Healthcare Provider: Before starting any medication for reducing body mass, engage in a comprehensive conversation with your healthcare provider. This discussion should focus on your health objectives and the most suitable treatment options tailored to your needs, particularly considering the personalized care offered by Tyde Wellness.

- Maintain Comprehensive Records: Keep meticulous documentation of all medical consultations, prescriptions, and related purchases throughout your journey to achieve a healthier body. This detailed record-keeping will be crucial for substantiating your claims for HSA reimbursements.

- Leverage Preventive Care Services: Many HSAs encompass coverage for preventive care services. Utilize these offerings to regularly monitor your health and make necessary adjustments to your slimming strategy, ensuring it remains effective and aligned with your goals.

- Stay Updated on HSA Regulations: Regularly review any changes to HSA regulations and coverage options. Awareness of updates in IRS guidelines or modifications to your health plan is semaglutide hsa eligible and can significantly impact your eligibility for specific medications.

- Seek Financial Guidance: If you find yourself uncertain about the optimal use of your HSA funds, consider consulting a financial advisor with expertise in health savings accounts. Their insights can help you refine your strategy and maximize your benefits effectively.

- Consider Body Reduction Counseling: If suggested by your doctor, body reduction counseling or membership in a body reduction group may also be reimbursable through your HSA. This can offer extra assistance on your journey to reduce your body mass.

By implementing these strategies, you can enhance your HSA advantages while striving towards your goal of reducing body mass. Participants in Tyde Wellness’s programs report an average body weight loss of 15% after 68 weeks, with many achieving weight loss exceeding 20-25% within a year, showcasing the effectiveness of a comprehensive approach to weight management.

💡 Tyde’s membership programs include physician supervision, coaching, and refills – all services that can often qualify for HSA or FSA use when prescribed.

Conclusion

Understanding whether semaglutide is HSA-eligible can make a major difference in how you manage both your health and finances.

By ensuring you meet eligibility criteria, maintain documentation, and partner with a healthcare provider like Tyde Wellness, you can confidently use your HSA funds toward your weight loss program.

Tyde’s team handles:

-

Medical documentation and eligibility verification

-

Prescription management

-

Ongoing support and follow-ups

This means you can focus on what matters most – feeling healthier, stronger, and more confident.

Take the Next Step

Ready to find out if your HSA covers semaglutide?

✅ Verify Your HSA Eligibility

💬 Book Your Consultation

At Tyde Wellness, we make it simple to understand your options, use your HSA or FSA funds, and begin your journey to real, lasting weight loss with compassionate medical guidance.

Frequently Asked Questions

What is required to qualify for a Health Savings Account (HSA)?

To qualify for an HSA, you must be enrolled in a high-deductible health plan (HDHP).

What are the minimum deductible amounts for HDHPs in 2025?

For 2025, the minimum deductible for individual coverage is $1,650, and for family coverage, it is $3,300.

What are the out-of-pocket expense limits for HDHPs in 2025?

The out-of-pocket expense limits for 2025 are $8,050 for individuals and $16,600 for families.

How can I confirm my HSA eligibility?

You can confirm your HSA eligibility by reviewing your proposal documents or consulting with your HR department.

What are the HSA contribution limits for 2025?

The HSA contribution limits for 2025 are $4,300 for individual coverage and $8,550 for family coverage.

Are there additional contribution allowances for older individuals?

Yes, individuals aged 55 or older can make an additional catch-up contribution of $1,000 each year.

What expenses can HSA funds be used for?

HSA funds can be used for qualified medical expenses, which include prescription medications, specific medical treatments, and preventive care.

Are HSA funds tax-free?

Yes, HSA funds can be used tax-free for qualified medical expenses at any time.

What happens to unused HSA funds?

Unused HSA funds roll over from year to year.

What occurs if I lose HSA eligibility due to life changes?

If you lose HSA eligibility, you still own the account and can use the funds for qualified expenses, but you must stop contributing until you regain eligibility.

List of Sources

- Understand HSA Eligibility Criteria

- Big Changes Are Coming to HSAs. See What It Means for Employers (https://shrm.org/topics-tools/news/benefits-compensation/hsa-changes-tax-law-employer-impact)

- IRS Releases HSA Limits for 2025 (https://padmin.com/blog/irs-releases-hsa-limits-for-2025)

- IRS Announces 2025 HSA, HDHP Limits (https://shrm.org/topics-tools/news/benefits-compensation/irs-announces-2025-hsa–hdhp-limits)

- Do You Meet the HSA Eligibility Requirements? | Lively (https://livelyme.com/blog/hsa-eligibility-requirements)

- Identify Semaglutide’s HSA Eligibility Requirements

- Flex – Can I Use My HSA/FSA for Semaglutide? (https://withflex.com/blog/can-i-use-my-hsa-for-semaglutide)

- More than half of all US adults are eligible for semaglutide therapy (https://news-medical.net/news/20241120/More-than-half-of-all-US-adults-are-eligible-for-semaglutide-therapy.aspx)

- More than half of U.S. adults eligible for semaglutide treatment (https://ems1.com/pharmacology/more-than-half-of-u-s-adults-eligible-for-semaglutide-treatment)

- You Can Now Use Your HSA/FSA On Semaglutide Weight Loss! — The Elements (https://elementsoftherapy.com/news/you-can-now-use-your-hsafsa-on-semaglutide-weight-loss)

- Verify Your HSA Coverage for Semaglutide

- Pennsylvania woman speaks out after Independence Blue Cross drops weight loss drug coverage (https://cbsnews.com/philadelphia/news/independence-blue-cross-weight-loss-drugs)

- Are GLP-1 Medications FSA/HSA Eligible – Your 2024 Guide (https://ivimhealth.com/fsa-hsa-eligible-glp1-medications-guide?srsltid=AfmBOoozn3Vib0eMpQeXBZCJ-vxouwPPPOkkQhXjoiH_owoLIXEsNSr0)

- You Can Now Use Your HSA/FSA On Semaglutide Weight Loss! — The Elements (https://elementsoftherapy.com/news/you-can-now-use-your-hsafsa-on-semaglutide-weight-loss)

- Flex – Can I Use My HSA/FSA for Semaglutide? (https://withflex.com/blog/can-i-use-my-hsa-for-semaglutide)

- Maximize Your HSA Benefits for Weight Loss Medications

- Using health FSAs and HSAs for weight loss programs and drugs | Christensen Group (https://christensengroup.com/article/using-health-fsas-and-hsas-for-weight-loss-programs-and-drugs)

- Employers enhanced health benefits in 2024, adding coverage for weight-loss medications and IVF despite growing health cost (https://mercer.com/en-us/about/newsroom/employers-enhanced-health-benefits-in-2024-adding-coverage-for-weight-loss-medications-and-ivf-despite-growing-health-cost)

- Positioning HSAs as a Weight Loss Add-On (https://getmyhsa.com/post/meeting-ozempic-demands-positioning-hsas-as-a-weight-loss-add-on)